2016 WL 7209725

Only the Westlaw citation is currently available.

Court of Appeal,

Fifth District, California.

STAND UP FOR CALIFORNIA! et al., Plaintiffs and Appellants,

v.

STATE of California et al., Defendants and Respondents;

North Fork Rancheria of Mono Indians, Intervener and Respondent.

F069302

|

Filed 12/12/2016

APPEAL from a judgment of the Superior Court of Madera County. Michael J. Jurkovich, Judge. (Super. Ct. No. MCV062850)

Attorneys and Law Firms

Snell & Wilmer, Sean M. Sherlock, Todd E. Lundell, Costa Mesa, and Brian A. Daluiso for Plaintiffs and Appellants.

Kamala D. Harris, Attorney General, Sara J. Drake, Assistant Attorney General, William P. Torngren and Timothy M. Muscat, Deputy Attorneys General, for Defendants and Respondents.

Maier, Pfeffer, Kim, Geary & Cohen, John A. Maier; Wilmer, Cutler, Pickering, Hale & Dorr, Danielle Spinelli and Christopher E. Babbitt for Intervener and Respondent.

OPINION

Smith, J.

*1 Plaintiffs Stand Up for California! and Barbara Leach (plaintiffs) initiated this litigation by filing a complaint challenging the Governor’s authority to concur in the decision of the Secretary of the United States Department of the Interior to take land in Madera County into trust for defendant North Fork Rancheria of Mono Indians (North Fork) for the purpose of operating a casino for class III gaming. The Governor’s concurrence was a necessary element under federal law for the granting of permission to North Fork to operate the casino on the land. While the case was pending, the Legislature passed a statute ratifying a compact previously negotiated and executed with North Fork by the Governor. This compact is a device authorized by federal law to allow a state to agree with an Indian tribe on the terms and conditions under which gambling can take place on Indian land within the state. Plaintiffs then initiated Proposition 48, a referendum by which, at the 2014 general election, the voters disapproved the ratification statute. North Fork, having intervened, filed a cross-complaint alleging that the ratification statute was not subject to the referendum process.

North Fork and the state defendants—the Governor, the Attorney General, the California Gambling Control Commission, the Bureau of Gambling Control, and the State of California—demurred to plaintiffs’ complaint challenging the Governor’s concurrence authority. Plaintiffs and the state defendants demurred to North Fork’s cross-complaint challenging the referendum.

The trial court sustained all the demurrers without leave to amend. The complaint and cross-complaint were dismissed. The result was that the land remained in trust for North Fork, but the compact was not ratified, so class III gaming on the land was not approved. Subsequently, however, as a product of federal litigation between North Fork and the state, a set of procedures designed to function as an alternative to a state-approved compact was approved by the Secretary of the Interior.

Appeals were filed from both judgments of dismissal, but the parties agreed to dismiss North Fork’s appeal in the case challenging the referendum, leaving only the concurrence issue. In my view, for reasons related to the lack of a state-approved compact or any future prospect of a state-approved compact for gambling on the land, any authority the Governor might have had to concur in a decision of the Secretary of the Interior to take the land into trust for purposes of gaming was inapplicable in this case, so the demurrers to plaintiffs’ claims on that issue should have been overruled.

FACTS AND PROCEDURAL HISTORY1

North Fork is a federally recognized Indian tribe with about 1,900 tribal citizens. It possesses a small rancheria in the Sierra Nevada foothills near the unincorporated community of North Fork. In March 2005, North Fork applied to the United States Department of the Interior (DOI) pursuant to the federal Indian Gaming Regulatory Act (18 U.S.C. §§ 1166-1167; 25 U.S.C. § 2701 et seq.) (IGRA) to have the federal government take into trust for North Fork’s benefit a 305-acre parcel in Madera County about 40 miles from the rancheria. The parcel, owned by North Fork’s development partner, is located on State Route 99 adjacent to the City of Madera. North Fork proposed building a hotel and casino on the site. Federal action taking the land into trust was a precondition to legal class III gaming under federal law. (25 U.S.C. § 2719(b)(1).) Class III gaming is the type of gambling practiced in casinos in Nevada. (25 U.S.C. § 2703(6)-(8).)

*2 In September 2011, DOI made a finding that, within the meaning of IGRA, taking the land into trust for the purpose of gaming would be in the best interest of North Fork and would not be detrimental to the surrounding community. (25 U.S.C. § 2719(b)(1)(A).) The Governor, fulfilling a role delineated in IGRA, concurred in this determination in August 2012. (25 U.S.C. § 2719(b)(1)(A).) The Secretary of the Interior decided to take the land into trust in November 2012, and the conveyance was completed on February 5, 2013.

Concurrently with this process, the Governor pursued a tribal-state compact under Government Code section 12012.25 and article IV, section 19, subdivision (f), of the California Constitution. Under IGRA, a tribal-state compact is one of the methods of legalizing class III gaming on Indian land. (25 U.S.C. § 2710(d)(1)(C).) In August 2012, the Governor announced that he had negotiated and signed a compact with North Fork for gaming on the 305-acre parcel and was forwarding the compact to the Legislature for ratification.

Plaintiffs filed their complaint on March 27, 2013. As amended, the complaint named as defendants the State of California, the Governor, the Attorney General, the Gambling Control Commission, and the Bureau of Gambling Control. It alleged that the Governor’s concurrence in the Secretary of the Interior’s determination violated the California Constitution because such a concurrence was not within the Governor’s power. The complaint prayed for a writ of mandate setting aside the concurrence.

A statute ratifying the compact, designated Assembly Bill No. 277, was passed by both houses of the Legislature. The Governor signed it on July 3, 2013, and it became chapter 51 of the Statutes of 2013. In addition to ratifying the compact, the statute exempted the casino project from compliance with the California Environmental Quality Act (Pub. Resources Code, § 21000 et seq.) (CEQA). (Stats. 2013, ch. 51, § 1(b).) The compact contained provisions, however, that required North Fork to produce a tribal environmental impact report similar to a CEQA environmental impact report. The compact was forwarded to the Secretary of the Interior, who published a notice in the Federal Register on October 22, 2013, stating that the compact was approved and was taking effect to the extent it was consistent with IGRA. (78 Fed.Reg. 62649 (Oct. 22, 2013).)

In the compact, the state authorized North Fork to conduct class III gaming on the 305-acre parcel, and North Fork agreed not to conduct gaming on its environmentally sensitive rancheria or elsewhere in California. North Fork agreed to make payments to the Chukchansi Tribe to mitigate the economic impact of the new casino on the existing Chukchansi casino. North Fork also agreed to share revenue with the Wiyot Tribe in order to enable that tribe to forgo gaming on its environmentally sensitive land near Humboldt Bay National Wildlife Refuge. North Fork further agreed to participate in a revenue-sharing scheme to benefit other tribes without casinos. The compact included many additional terms, including North Fork’s submission to detailed regulations for the operation of its casino.

On July 8, 2013, Cheryl Schmit, using the letterhead of Stand Up for California!, asked the Attorney General for a title and summary for a proposed statewide referendum rejecting the compact ratification statute, chapter 51 of the Statutes of 2013. The Attorney General issued the title and summary, and signatures were gathered. The referendum qualified for the November 2014 general election ballot.

*3 North Fork, which was not originally a party to the litigation initiated by plaintiffs’ complaint, was granted leave to intervene on August 23, 2013. North Fork filed its cross-complaint on February 27, 2014, naming the state defendants as cross-defendants. Schmit, the official proponent of the referendum petition, was named as a real party in interest. The cross-complaint sought a declaratory judgment stating that the referendum petition was invalid.

North Fork and the state defendants demurred to plaintiffs’ complaint (alleging that the Governor’s concurrence was unauthorized), and the trial court ruled on the demurrers on March 3, 2014. In its written ruling, the court stated that the Governor’s power to concur arose by implication from his authority to negotiate and execute tribal-state compacts, as set forth in article IV, section 19, subdivision (f), of the California Constitution. Because the Governor was authorized to negotiate compacts for gaming on Indian land, and some such compacts, including the one at issue in this case, cannot come into effect unless the land in question is taken into trust by the federal government with the Governor’s concurrence, the Governor must have the power to concur. The court rejected plaintiffs’ argument that when the voters added article IV, section 19, subdivision (f), to the California Constitution via Proposition 1A in 2000, they intended to deny to the state the authority to approve Indian casinos on land that was not yet Indian land at the time, so that there could be no casinos on newly added trust land. Plaintiffs conceded they could not cure their complaint by amendment, so the demurrers were sustained without leave to amend. A defense judgment was entered on March 12, 2014.

Plaintiffs, Schmit, and the state defendants demurred to North Fork’s cross-complaint (challenging the validity of the referendum), and the trial court ruled on the demurrers on June 26, 2014. The court wrote that the plain language of article II, section 9, subdivision (a), of the California Constitution was controlling. That provision states that the referendum power allows the voters to reject “statutes or parts of statutes except urgency statutes, statutes calling elections, and statutes providing for tax levies or appropriations for usual current expenses of the State.” It was undisputed that chapter 51 of the Statutes of 2013 was a statute and not within one of those three exceptions. The court rejected North Fork’s argument that the ratification of the compact was in substance administrative, not legislative, so it was not subject to referendum despite its statutory form. The court also rejected North Fork’s argument that, in order to avoid a conflict between state law and IGRA, state law must be interpreted to deny the voters power to invalidate a tribal-state compact. North Fork declared it would not attempt to cure its cross-complaint by amendment, so the demurrers were sustained without leave to amend. Judgment dismissing the cross-complaint was entered on July 9, 2014.

The referendum was designated Proposition 48. A majority of voters voted “no” on Proposition 48 on November 4, 2014, thereby rejecting the Legislature’s ratification of the compact. (Historical and Statutory Notes, 32E pt. 1 West’s Ann. Gov. Code (2016 supp.) foll. § 12012.59, p. 13.)

Plaintiffs appealed from the dismissal of their complaint. North Fork appealed from the dismissal of its cross-complaint. On May 25, 2016, however, the parties filed a stipulation to dismiss North Fork’s appeal, thus removing the referendum issue from the case. Only the question of the Governor’s concurrence power remains.

*4 On August 3, 2016, plaintiffs filed an unopposed request for judicial notice of action by DOI to approve a document called Secretarial Procedures for the North Fork Rancheria of Mono Indians (the secretarial procedures). According to a letter from DOI included in the request for judicial notice, the secretarial procedures were issued as a remedy for North Fork in litigation in federal court. In this litigation, as a consequence of the voters’ rejection of the compact via Proposition 48, the court found the state failed to negotiate with North Fork in good faith. This led to court-ordered mediation, which, producing no settlement, led in turn to the district court’s approval a set of procedures proposed by North Fork to regulate gambling on the 305-acre site in the absence of a state-approved compact. These procedures were submitted to DOI and, upon approval by the Secretary of the Interior, became the secretarial procedures. The letter, dated July 29, 2016, states that the secretarial procedures are in effect. This request for judicial notice is granted.2

DISCUSSION

I. Standard of review

The standard of review is well-established:

“In an appeal from a judgment dismissing an action after a general demurrer is sustained without leave to amend, our Supreme Court has imposed the following standard of review. ‘The reviewing court gives the complaint a reasonable interpretation, and treats the demurrer as admitting all material facts properly pleaded. [Citations.] The court does not, however, assume the truth of contentions, deductions or conclusions of law. [Citation.] The judgment must be affirmed “if any one of the several grounds of demurrer is well taken. [Citations.]” [Citation.] However, it is error for a trial court to sustain a demurrer when the plaintiff has stated a cause of action under any possible legal theory. [Citation.] And it is an abuse of discretion to sustain a demurrer without leave to amend if the plaintiff shows there is a reasonable possibility any defect identified by the defendant can be cured by amendment. [Citation.]’ [Citations.].” (Genesis Environmental Services v. San Joaquin Valley Unified Air Pollution Control Dist. (2003) 113 Cal.App.4th 597, 603.)

II. Legal framework for Indian gaming

IGRA was enacted in 1988. (Pub.L. No. 100-497 (Oct. 17, 1998) 102 Stat. 2467.) Its primary purpose is “to provide a statutory basis for the operation of gaming by Indian tribes as a means of promoting tribal economic development, self-sufficiency, and strong tribal governments.” (25 U.S.C. § 2702(1).)

Under IGRA, gambling is divided into three classes. Class I is “social games solely for prizes of minimal value or traditional forms of Indian gaming” connected with “tribal ceremonies or celebrations.” (25 U.S.C. § 2703(6).) On Indian lands, class I gaming is not subject to IGRA and is within the exclusive jurisdiction of Indian tribes. (25 U.S.C. § 2710(a)(1).) Class II is bingo, games similar to bingo, and certain card games. (25 U.S.C. § 2703(7).) IGRA places class II gaming on Indian lands under tribal jurisdiction in any state in which class II gaming is ever permitted by state law, subject to regulations in IGRA itself. (25 U.S.C. § 2710(b).)

Class III is all other gaming. (25 U.S.C. § 2703(8).) It includes “ ‘high-stakes casino-style’ gaming” and encompasses slot machines, casino games, banking card games, dog racing and lotteries, among other things. (Keweenaw Bay Indian Community v. United States (6th Cir. 1998) 136 F.3d 469, 473.) IGRA permits class III gaming on Indian lands in any state in which class III gaming is ever permitted by state law, provided that the state and tribe enter into a tribal-state compact setting forth terms under which the gaming is to be conducted. (25 U.S.C. § 2710(d).)

*5 Upon request by a tribe, a state is required to negotiate in good faith to enter into a tribal-state compact.3 (25 U.S.C. § 2710(d)(3)(A).) After a state and a tribe enter into a compact, the compact is submitted to the Secretary of the Interior for review. The secretary has 45 days to approve or disapprove the compact; if he or she does not act within 45 days, the compact is deemed approved. The Secretary is authorized to disapprove a compact only if it fails to conform to federal law. (25 U.S.C. § 2710(d)(3)(B), (d)(8).)

IGRA provides that, in general, gaming is not authorized on land acquired by the DOI in trust for an Indian tribe after the effective date of the statute, October 17, 1988. (25 U.S.C. § 2719(a).) One exception is when “the Secretary, after consultation with the Indian tribe and appropriate State and local officials, including officials of other nearby Indian tribes, determines that a gaming establishment on newly acquired lands would be in the best interest of the Indian tribe and its members, and would not be detrimental to the surrounding community, but only if the Governor of the State in which the gaming activity is to be conducted concurs in the Secretary’s determination....” (25 U.S.C. § 2719(b)(1)(A).) This is the provision, involving what is often referred to as the two-part determination, under which the Governor concurred in the conversion of the 305-acre parcel to trust status in this case.

When IGRA was enacted, the California Constitution prohibited all casino-type gambling statewide. (Cal. Const., art. IV, § 19, subd. (e); California Commerce Casino, Inc. v. Schwarzenegger (2007) 146 Cal.App.4th 1406, 1411.) An initiative statute passed in 1998, Proposition 5, purported to authorize the state to enter into tribal-state compacts as contemplated by IGRA, but because the measure was only statutory, it was held to be invalid in light of the constitutional gambling prohibition. (Hotel Employees & Restaurant Employees Internat. Union v. Davis (1999) 21 Cal.4th 585, 589-590 (Hotel Employees).) In 2000, the voters approved Proposition 1A, which amended the California Constitution to authorize the state to enter into tribal-state compacts. (Cal. Const., art. IV, § 19, subd. (f); Historical Notes, 1E West’s Ann. Cal. Const. (2012 ed.) foll. art. IV, § 19, p. 604.) The Legislature enacted Government Code section 12012.25, authorizing the Governor to negotiate and execute tribal-state compacts and requiring the Governor to submit executed compacts to the Legislature for ratification. (Gov. Code, § 12012.25, subds. (d)-(e).)4

III. Governor’s concurrence power

*6 Plaintiffs maintain that no authority can be found in state law empowering the Governor to concur in a finding by the Secretary of the Interior that taking land into trust for an Indian tribe for gaming purposes is in the best interest of the tribe and not detrimental to the surrounding community, within the meaning of IGRA. North Fork and the state defendants argued in the trial court, and argue again now, that the Governor should be found to have this authority according to three different analyses: (1) the Governor’s authority to concur arises by implication from his express authority to negotiate and execute compacts; (2) the Governor has authority to concur as part of his inherent authority as head of the executive branch of government; and (3) the Legislature impliedly ratified the concurrence when it ratified the compact, effectively supplying the Governor with authority after the fact. The trial court agreed with the first argument and did not address the others.

The parties agree that no statutory, constitutional, or other authority under state law explicitly authorizes the Governor to exercise the concurrence power contemplated by IGRA. Further, as plaintiffs point out, it has been held that any authority with which the Governor acts in granting his concurrence under IGRA must be based on state law; IGRA itself does not supply that authority:

“When the Governor exercises authority under IGRA, the Governor is exercising state authority. If the Governor concurs, or refuses to concur, it is as a State executive, under the authority of state law. The concurrence (or lack thereof) is given effect under federal law, but the authority to act is provided by state law.... In the present case, the consequences of the Governor’s exercise of discretion under state law will affect how the Secretary of the Interior will proceed to execute IGRA. No doubt, federal law provides the Governor with an opportunity to participate in the determination of whether gaming will be allowed on newly acquired trust land. But when the Governor responds to the Secretary’s request for a concurrence, the Governor acts under state law, as a state executive, pursuant to state interests.” (Confederated Tribes of Siletz Indians of Oregon v. United States (9th Cir. 1997) 110 F.3d 688, 697-698 (Confederated Tribes).)

The Ninth Circuit made this point to show that, when a governor concurs or refuses to concur, he or she does not exercise significant authority under federal law, and does not possess primary responsibility for protecting a federal interest, and therefore IGRA’s employment of a state official to carry out a part of the statutory scheme does not violate the appointments clause of the federal Constitution. (Confederated Tribes, supra, 110 F.3d at pp. 696-698.) Under this reasoning, it follows that if no state law authorized the Governor to concur, then he lacked authority to do it.

In my view, the argument adopted by the trial court is indeed the most plausible of the arguments made by plaintiffs: The needed authority, if it exists, is found by implication in state law authorizing the Governor to negotiate and execute tribal-state compacts. Article IV, section 19, subdivision (f), of the California Constitution, which was added by Proposition 1A in 2000, states: “[T]he Governor is authorized to negotiate and conclude compacts, subject to ratification by the Legislature, for the operation of slot machines and for the conduct of lottery games and banking and percentage card games by federally recognized Indian tribes on Indian lands in California in accordance with federal law.” The Legislature provided substantially the same authority in Government Code section 12012.25, subdivision (d): “The Governor is the designated state officer responsible for negotiating and executing, on behalf of the state, tribal-state gaming compacts with federally recognized Indian tribes located within the State of California pursuant to the federal Indian Gaming Regulatory Act of 1988 (18 U.S.C. Sec. 1166 to 1168, incl., and 25 U.S.C. Sec. 2701 et seq.) for the purpose of authorizing class III gaming, as defined in that act, on Indian lands within this state.” In the opinion of the tribe, the state defendants and the trial court, this constitutional provision and this statute are rightly construed as empowering the Governor to concur in the Secretary of the Interior’s determination under title 25 of United States Code section 2719(b)(1)(A) because of the unrestricted reference in both to “Indian lands.” As I will explain, however, I need neither endorse nor reject that reasoning in this case. Even if it is correct, the Governor’s implied concurrence power would not extend to lands as to which there is no state-approved compact, nor any prospect of one, since the point of the implied concurrence power would be to give effect to the state’s compacting power.

*7 In interpreting a statute, our objective is “to ascertain and effectuate legislative intent.” (People v. Woodhead (1987) 43 Cal.3d 1002, 1007.) To the extent the language in the statute may be unclear, we look to legislative history and the statutory scheme of which the statute is a part. (People v. Bartlett (1990) 226 Cal.App.3d 244, 250.) We look to the entire statutory scheme in interpreting particular provisions “so that the whole may be harmonized and retain effectiveness.” (Clean Air Constituency v. California State Air Resources Bd. (1974) 11 Cal.3d 801, 814.) “In the end, we ‘ “must select the construction that comports most closely with the apparent intent of the Legislature, with a view to promoting rather than defeating the general purpose of the statute, and avoid an interpretation that would lead to absurd consequences.” [Citation.]’ ” (Torres v. Parkhouse Tire Service, Inc. (2001) 26 Cal.4th 995, 1003.) The same principles apply to the interpretation of a voter initiative. Analyses and arguments contained in the official ballot pamphlet are relevant when the language of the enactment is unclear. (Robert L. v. Superior Court (2003) 30 Cal.4th 894, 900-901.)

As the tribe and the state defendants point out, the term “Indian lands” includes both land on Indian reservations and land taken into trust by the federal government for the benefit of Indian tribes. (25 U.S.C. § 2703(4).) Trust lands include those taken into trust for gaming purposes after 1988 under title 25 of United States Code section 2719(b)(1)(A), the provision requiring the Secretary of the Interior’s findings and the Governor’s concurrence. Thus, the argument goes, the Governor cannot meaningfully negotiate and execute tribal-state compacts for some Indian lands—those taken into trust after 1988 under title 25 of United States Code section 2719(b)(1)(A)—unless he can also exercise the concurrence power contemplated by that provision. It is well established that governmental officials in California have implied power to take action necessary for the administration of powers expressly granted by law. (Dickey v. Raisin Proration Zone No. 1 (1944) 24 Cal.2d 796, 810; Crawford v. Imperial Irrig. Dist. (1927) 200 Cal. 318, 334; Watt v. Smith (1891) 89 Cal. 602, 604.) It follows, the tribe and the state defendants aver, that the Governor must have the power to concur in a determination to take land into trust for gaming when the state’s power to make a compact for gaming on that land is exercised.

The trouble for this argument in this case is that we now know the state’s power to make a compact is not being exercised for gaming on the 305-acre parcel. The voters decided to reject the compact that was negotiated and ratified; the tribe has dismissed its appeal in the litigation that was designed to revive that compact; and no new compact has been proposed by any party. Instead, the casino project is poised to proceed, but for the issue in this appeal, based on the secretarial procedures, which have been imposed against the state’s will.

I do not believe an implied concurrence power can be held to exist under these circumstances. Laws are deemed to have implied provisions and confer implied powers only when necessary for the carrying out of express provisions and powers. An implied power should have no greater scope than this necessity requires. “ ‘ “[F]or a consequence to be implied from a statute there must be greater justification for its inclusion than a consistency or compatibility with the act from which it is implied. ‘A necessary implication within the meaning of the law is one that is so strong in its probability that the contrary thereof cannot reasonably be supposed.’ ” ‘ ” (Lubner v. City of Los Angeles (1996) 45 Cal.App.4th 525, 529.) It may be appropriate (there is no need to decide) to say that the Governor’s concurrence power is necessary under this standard to carry out the provisions of Proposition 1A because those provisions contemplate the possibility of state-approved tribal-state compacts for class III gaming on any Indian lands as defined by law, and some such compacts (those for post-1988 trust lands) cannot be made effective without a gubernatorial concurrence in a DOI finding regarding the land in question. But it would make no sense to say the gubernatorial concurrence power arises by necessary implication from the compacting power in Proposition 1A because secretarial procedures that have been issued cannot meaningfully become effective unless the Governor’s concurrence makes the land available. The concept of necessity limits the scope of any implied concurrence power to situations in which gambling on the land in question will be conducted pursuant to a state-approved compact, and the concurrence power is necessary to make such a compact effective. The concurrence power is not necessary to the carrying out of the compacting power in cases in which the compacting power is not being exercised.

*8 In summary, it would be perverse to find the Governor has an implied authority based on an express power that the state has finally decided not to exercise, after protracted consideration by the Governor, the Legislature, and the voters. It is no denigration of the Governor’s authority to say he cannot exercise an implied power in a case where the voters have vetoed an exercise of the express power on which the implied power is purportedly based.

The effect of this conclusion is that the Governor’s concurrence for the 305-acre parcel is invalid without a state-approved compact for gaming on that parcel. Would that concurrence become valid if a new state-approved compact should come into being? It is not necessary to answer that question in this opinion.

IV. Inherent authority and implied ratification

North Fork and the state defendants argue that, even if there is no implied gubernatorial concurrence authority in the Proposition 1A compacting power, the Governor had inherent authority to give his concurrence, and the Legislature provided any missing authority by impliedly ratifying the concurrence when it ratified the compact. I turn to these arguments now.

A. Inherent executive authority

The notion that the Governor has inherent power to grant his concurrence is approached from several angles in the briefs for North Fork and the state defendants. The state defendants and North Fork both undertake to rebut the idea that there would be a separation-of-powers violation if the Governor had the concurrence power because, in exercising the concurrence power, the Governor infringes on or usurps a legislative function. The Governor’s action is invalid because there is a lack of authority for it in the first place, not because the action infringes on the Legislature’s domain, so there is no need to address this contention.5 North Fork also argues, however, that the concurrence power is “[i]nherently [e]xecutive” and that the power “is a natural consequence of [the Governor’s] role as the head of the administrative state.” North Fork cites article V of the California Constitution, which states that “[t]he supreme executive power of this State is vested in the Governor,” and “[t]he Governor shall see that the law is faithfully executed.” (Cal. Const., art. V, § 1.) I understand these contentions to mean that the Governor is entitled to exercise the concurrence power contemplated by IGRA simply because he is the Governor; no specific express or implied grant of power is necessary under this view.

Among the cases cited by North Fork in connection with this argument, two seem most relevant: United States v. 1,216.83 Acres of Land (Wash. 1978) 574 P.2d 375 (1,216.83 Acres) and Lac Courte Oreilles Band of Lake Superior Chippewa Indians of Wisconsin v. United States (7th Cir. 2004) 367 F.3d 650 (Lac Courte Oreilles). But neither of these shows that the Governor has inherent executive authority, independent of any specific express or implied grant of power, to issue concurrences as contemplated by IGRA.

In 1,216.83 Acres, the question was whether the governor of the State of Washington had authority to designate the state’s game commission as the agency responsible for approving federal land acquisitions for purposes of establishing migratory bird refuges pursuant to a federal statute, the Migratory Bird Conservation Act. (1,216.83 Acres, supra, 574 P.2d at pp. 376-377.) The federal law provided that such acquisitions had to be approved by the governor or appropriate state agency in each state. (Id. at p. 376.) The Washington Supreme Court held that the game commission had the necessary authority to grant the approvals because a state statute expressly conferred on the commission authority to enter into agreements with the United States on all matters regarding wildlife conservation. (Ibid.) Then the court held that, although there was no state statute or state constitutional provision specifically authorizing the governor to designate the commission, there was implied authority in “the Governor’s position as head of the executive branch of government.” (Id. at p. 379.) Further, the Governor’s authority to designate the agency was apparent “[i]n view of the extensive authority the Governor has already been given by statute over the game department and its personnel....” (Ibid.)

*9 The situation in 1,216.83 Acres is not similar to the situation here. The Migratory Bird Conservation Act called for certain action by an appropriate state agency, and a Washington statute named the agency responsible for such action. In designating that agency, the Governor of Washington merely pointed out what the state statute had already made clear. It was obvious that the governor had inherent authority to follow a state statute and direct a state agency to follow it. The Supreme Court of Washington rightly devoted only a single paragraph of analysis to this easy question. In our case, there is no state statute or other state law explicitly giving anyone responsibility for participating in the two-part determination necessary to take land into trust for gambling under IGRA. Further, even if I thought Proposition 1A impliedly gave the Governor the necessary authority in general, I would conclude that the authority is limited to land on which gambling will be conducted under a state-approved compact.

In Lac Courte Oreilles, the Governor of Wisconsin refused to concur in the Secretary of the Interior’s two-part determination for land on which three tribes proposed to operate a casino. (Lac Courte Oreilles, supra, 367 F.3d at p. 653.) The tribes sued for a declaration that the concurrence requirement in IGRA was unconstitutional. (Lac Courte Oreilles, supra, at p. 652.) One argument the tribes made was that the concurrence provision violated principles of federalism because it required governors to create state public policy, a function state constitutions commit to state legislatures. (Id. at p. 664.) Rejecting this contention, the Seventh Circuit reasoned that Wisconsin already had a policy on gambling expressed in its laws authorizing a state lottery and allowing bingo and raffles by certain nonprofit organizations. (Ibid.) Applying California v. Cabazon Band of Mission Indians (1987) 480 U.S. 202 (Cabazon), the Seventh Circuit then concluded that, because the state did not prohibit all gambling, its policy was to tolerate gaming on Indian lands (since Cabazon held that a state cannot prohibit gaming on Indian lands if it chooses to permit any gambling elsewhere). The Governor, in deciding whether to grant or withhold a requested concurrence, thus made no new policy but was guided by the old policy and acted in a manner “typical of the executive’s responsibility to render decisions based on existing policy.” (Lac Courte Oreilles, supra, at p. 664.)

North Fork argues that, from the rationale of Lac Courte Oreilles, it follows that the Governor is merely acting within existing California gambling policy when he concurs in a two-part determination by the Secretary of the Interior, and therefore he needs no specific authority to do it.

I do not believe Lac Courte Oreilles supports this conclusion. The question in that case was whether the concurrence provision violated federalism principles because it involved the federal government compelling a governor to create state public policy, an act reserved by the state constitution to the state legislature. The answer given by the Seventh Circuit was that there was no such violation of federalism principles because, under the reasoning of Cabazon, the state already had a policy regarding Indian casinos, so the governor did not create a new policy by concurring or declining to concur. Under Cabazon and Lac Courte Oreilles, California would also properly be said to have a policy regarding Indian casinos and the Governor’s exercise of the concurrence power would not create that policy. This does not show, however, that the power to concur is inherent in the Governor’s office. There is no rule that the Governor has inherent authority to take any action he pleases in areas in which the state has an existing public policy.

In sum, Lac Courte Oreilles held only that the concurrence provision does not violate the federal Constitution because it does not force governors to usurp state legislative authority by making state public policy. It did not consider the question of whether any governor has inherent executive authority to exercise the concurrence power under any state’s law. “Language used in any opinion is of course to be understood in the light of the facts and the issue then before the court, and an opinion is not authority for a proposition not therein considered.” (Ginns v. Savage (1964) 61 Cal.2d 520, 524, fn. 2.)

*10 North Fork next says there are many federal statutes that call on the Governor to take actions without specific authority under state law, and “chaos would ensue” if such specific authority were held to be required. For instance, one section of a federal law on the establishment of airports in national parks provides that the Secretary of the Interior can acquire the necessary land, but only with “the consent of the Governor of the State, and the consent of chief executive official of the State political subdivision, in which the land is located.” (54 U.S.C. § 101501(c)(2).) Similarly, under the Uranium Mill Tailings Radiation Control Act, the Secretary of Energy is allowed to acquire land for radioactive materials disposal but in certain states must obtain “the consent of the Governor of such State.” (42 U.S.C. § 7916.) North Fork claims there is no specific authority in California law that would allow the Governor to give consent under these statutes.

My analysis implies nothing regarding the Governor’s authority to act in connection with these other federal laws. I do not go beyond the proposition that there is no concurrence power when, on the land at issue, the proposed gambling establishment would be operated under authority other than a state-approved compact. In other words, if the concurrence power exists, it is limited by the purposes of the state law in connection with which it would be exercised, that is, the purposes of Proposition 1A. Those purposes involve the legalization of gambling in casinos regulated by state-approved compacts, not those regulated by secretarial procedures imposed over the state’s resistance. I think this limit would exist even if the Governor’s power were supported by inherent executive authority. If a statute limits the power of the Governor, the Governor would not be entitled to exceed that limit based on the theory that the power is part of his inherent authority. So it would be, at least, if the statutory limit did not amount to an unconstitutional legislative infringement on executive authority.

In short, I draw no conclusion about whether the Governor has inherent authority to grant concurrences under IGRA in general, let alone whether he has authority to give consent to federal actions under other federal laws. I aver only that any authority he has to grant concurrences under IGRA is limited to land on which gambling will be subject to a state-approved compact.

Finally, North Fork claims the concurrence power is authorized by the Governor’s statutory role as the “sole official organ of communication” between California and the United States (Gov. Code, § 12012) and his statutory authority to “require executive officers and agencies and their employees to furnish information relating to their duties” (Cal. Const., art. V, § 4). This is not persuasive. The concurrence power involves more than communication or furnishing information.

B. Implied ratification

North Fork’s final argument is that when the Legislature ratified the compact, it impliedly also ratified the Governor’s concurrence, thereby supplying any authority that might have been lacking. This argument might have been persuasive had the compact been upheld in the 2014 election. As I have explained, however, any concurrence power the Governor possesses can operate only with respect to land on which gambling will be regulated by a state-approved compact. The voters have defeated the ratification of the compact, North Fork has withdrawn its legal challenge to the validity of the referendum, the state has declined to agree to a new compact via court-ordered mediation, secretarial procedures have been issued, and no party claims there is now any prospect of a state-approved compact for gambling on the 305-acre parcel. Even if the Governor’s concurrence would have been valid otherwise, it is not valid under these circumstances.

V. Dismissal of state defendants other than the Governor

*11 The state defendants argue that the claims against all of them except the Governor—that is, the Attorney General, the California Gambling Control Commission, the Bureau of Gambling Control and the State of California—should be dismissed as moot because plaintiffs sought only a judgment prohibiting them from enforcing or implementing provisions of the compact. Section 8.2 of the secretarial procedures, however, gives the state the option of participating in the regulation of gambling on the 305-acre site under those procedures. In light of this, plaintiffs might still wish to pursue relief against all the state defendants and might be able to amend their complaint accordingly. Consequently, I conclude that plaintiffs’ claims against these defendants are not moot.

DISPOSITION

The judgment is reversed. The Governor’s concurrence is invalid under the facts alleged in this case. Plaintiffs have stated a cause of action for a writ of mandate to set the concurrence aside on the ground that it is unsupported by legal authority. The matter is remanded for further proceedings, and the trial court is directed to vacate its order sustaining the demurrers and enter a new order overruling them.

The request for judicial notice filed by plaintiffs on August 3, 2016, is granted.

The motion filed by plaintiffs on October 4, 2016, to strike portions of North Fork’s supplemental brief is denied.

Appellants are awarded costs on appeal.

DETJEN, J., Concurring and Dissenting.

I join in the disposition as stated in the lead opinion. The trial court erred in sustaining the demurrers. I do not, however, think the analysis reaches the question of whether the Governor has “concurring” authority because, on the facts of this case, he could not exercise the limited authority to compact granted to him by article IV, section 19, subdivision (f) of the California Constitution (added by Prop. 1A, eff. Mar. 7, 2000).

This case arises from a complicated interplay between the federal law governing the acquisition and use of lands held in trust for Indian tribes, and the federal and state interests in regulating such land when used for gambling and related gaming activities. The parties1 initially briefed and argued a difficult question in this arena—whether, in order to execute the express constitutional authority to negotiate and conclude gaming compacts granted under Proposition 1A, the Governor has been implicitly granted the power to concur in the United States Secretary of the Interior’s (Secretary) determination that it would be in the best interest of the tribe and its citizens, and not detrimental to the surrounding community, to permit gaming on Indian lands. Upon our request, the parties submitted supplemental briefing on five questions, including whether “the failure of the 305-acre parcel to be ‘Indian lands’ prior to the time the Governor negotiated and executed the compact deprive[d] him of the authority to negotiate and execute the compact when he did” (italics omitted) and whether the voters’ defeat of the compact ratification or the recent approval of substitute procedures for gaming by the United States Department of the Interior affected this case.

Justice Smith opines state authority authorizing the Governor to concur most likely exists by implication in the language of Proposition 1A that authorizes the Governor to negotiate and execute tribal-state compacts. He concludes however that, since California voters vetoed the tribal-state compact through Proposition 48 in the November 4, 2014, General Election, the express power from which the power of concurrence could be implied no longer exists. An implied concurrence power, the analysis goes, cannot be exercised when the compact no longer exists.

*12 Justice Franson concludes no state authority authorizes the Governor to concur; it is neither stated in nor implied from Proposition 1A.2 He opines an implied grant of that power is not necessary under the principles of California law. He does not believe the authority can be found in general executive power.

In arguing the issues, the parties initially assumed the Governor was appropriately exercising the authority granted under Proposition 1A to negotiate gaming compacts in the first instance. In the supplemental briefing, appellants asserted the Governor lacked authority to compact in the first instance. Due to the unique structure of California’s constitutional provisions regarding casino-style gaming, I believe this later position is correct.

OVERVIEW OF THE RELEVANT LAW

“The Indian Reorganization Act ... authorizes the Secretary ... to acquire land and hold it in trust ‘for the purpose of providing land for Indians.’ ” (Carcieri v. Salazar (2009) 555 U.S. 379, 381-382.) The operative statute for this authority is 25 United States Code Service section 5108 (formerly, 25 U.S.C. § 465), which provides that the “Secretary ... is ... authorized, in his [or her] discretion, to acquire through purchase, relinquishment, gift, exchange, or assignment, any interest in lands, water rights, or surface rights to lands, within or without existing reservations, including trust or otherwise restricted allotments[,] whether the allottee be living or deceased, for the purpose of providing land for Indians.”

*13 As with many federal laws, there are additional federal regulations delineating how this authority will be exercised. In the case of accepting land into trust, these regulations are detailed at 25 Code of Federal Regulations parts 151.1 through 151.15. Under part 151.3, “land may be acquired for a tribe in trust status” in three circumstances: (1) when the property is “located within the exterior boundaries of the tribe’s reservation or adjacent thereto, or within a tribal consolidation area”; (2) when “the tribe already owns an interest in the land”; or (3) when the Secretary ... “determines that the acquisition of the land is necessary to facilitate tribal self-determination, economic development, or Indian housing.” With respect to accepting off-reservation land offered into trust under the third basis, the Secretary is guided by part 151.11, which lists several factors to consider, including the need of the tribe for the land, the purposes for which the land will be used, the impact on the state from removing the land from the tax rolls, potential conflicts of land use which may arise, the location of the land relative to state boundaries and the boundaries of the tribe’s reservation, and, in the case where land is being acquired for business purposes, the tribe’s plan specifying the anticipated economic benefits associated with the proposed use. (25 C.F.R. § 151.11(a)-(c) [incorporating 25 C.F.R. § 151.10(a)-(c) & (e)-(f) ].)

Comparatively, the primary purpose of the Indian Gaming Regulatory Act (IGRA) is “to provide a statutory basis for the operation of gaming by Indian tribes as a means of promoting tribal economic development, self-sufficiency, and strong tribal governments.” (25 U.S.C.S. § 2702(1).) Generally, class III gaming activities “shall be lawful on Indian lands” only when they are authorized by the tribe and approved by the Chairman of the Indian Gaming Commission, “located in a State that permits such gaming for any purpose by any person, organization, or entity,” and “conducted in conformance with a Tribal-State compact entered into by the Indian tribe and the State.” (Id., § 2710(d)(1).) Under the IGRA, any tribe “having jurisdiction over the Indian lands upon which a class III gaming activity is being conducted, or is to be conducted, shall request the State in which such lands are located to enter into negotiations for the purpose of entering into a Tribal-State compact.” (25 U.S.C.S. § 2710(d)(3).) The IGRA specifically defines “ ‘Indian lands’ ” as all land within the limits of any Indian reservation and “any lands title to which is ... held in trust by the United States for the benefit of any Indian tribe ... and over which an Indian tribe exercises governmental power.” (25 U.S.C.S. § 2703(4).)

However, the IGRA excludes any land taken into trust after October 17, 1988, from being used for gaming purposes unless certain exceptions apply. (25 U.S.C.S. § 2719(a).) Relevant here, land taken into trust after October 17, 1988, which is not otherwise permitted to be used for gaming by the IGRA, may be converted to such use if “the Secretary, after consultation with the Indian tribe and appropriate State and local officials, including officials of other nearby Indian tribes, determines that a gaming establishment on newly acquired lands would be in the best interest of the Indian tribe and its members, and would not be detrimental to the surrounding community, but only if the Governor of the State in which the gaming activity is to be conducted concurs in the Secretary’s determination.” (25 U.S.C.S. § 2719(b)(1)(A).)

Like the Indian Reorganization Act (IRA), the IGRA is also the subject of multiple federal regulations. (25 C.F.R. §§ 292.1-292.26.) Relevant to this appeal, the regulations define the phrase “[n]ewly acquired lands” as “land that has been taken, or will be taken, in trust for the benefit of an Indian tribe by the United States after October 17, 1988.” (25 C.F.R. § 292.2.) The regulations allow the Secretary to streamline the process for taking lands into trust for the purpose of allowing gaming to occur. The regulations demonstrate, however, that taking land into trust and allowing gaming to occur remain two separate processes. (See id., §§ 292.3(b) [“If the tribe seeks to game on newly acquired lands that require a land-into-trust application ... the tribe must submit a request for an opinion to the Office of Indian Gaming.”]; 292.15 [“A tribe can apply for a Secretarial Determination under § 292.13 for land not yet held in trust at the same time that it applies under part 151 of this chapter to have the land taken into trust.”].) Indeed, if in these dual processes, the Secretary notices an intent to take the land into trust for gaming purposes, but the Governor of the affected state issues a written non-concurrence, “the Secretary will withdraw that notice pending a revised application for a non-gaming purpose” and the land will not be taken into trust. (Id., § 292.23(a)(2).) If the land is already in trust or otherwise under control of the tribe, the tribe “may use the newly acquired lands only for non-gaming purposes.” (Id., § 292.23(a)(1).)

*14 California’s Constitution generally bans what is categorized as class III gaming under the IGRA. (Cal. Const., art. IV, § 19, subd. (e) [“The Legislature has no power to authorize, and shall prohibit, casinos of the type currently operating in Nevada and New Jersey.”].) As our Supreme Court explained: “In 1984, the people of California amended our Constitution to state a fundamental public policy against the legalization in California of casino gambling of the sort then associated with Las Vegas and Atlantic City.” (Hotel Employees & Restaurant Employees Internat. Union v. Davis (1999) 21 Cal.4th 585, 589 (Hotel Employees).) This prohibition led to the downfall of the first attempt to permit class III gaming on Indian land in California: Proposition 5. That proposition, which attempted to grant a statutory procedure for authorizing gaming on Indian lands, was held invalid3 in the face of California’s constitutional ban on casinos. (Hotel Employees, supra, 21 Cal.4th at p. 615.) In response, the California Constitution was amended through Proposition 1A.

Proposition 1A added article IV, section 19, subdivision (f), to the California Constitution: “Notwithstanding subdivisions (a) and (e), and any other provision of state law, the Governor is authorized to negotiate and conclude compacts, subject to ratification by the Legislature, for the operation of slot machines and for the conduct of lottery games and banking and percentage card games by federally recognized Indian tribes on Indian lands in California in accordance with federal law. Accordingly, slot machines, lottery games, and banking and percentage card games are hereby permitted to be conducted and operated on tribal lands subject to those compacts.”

DISCUSSION

The core issue in this case is the effect of Proposition 1A. The parties and my colleagues appear to agree that, if no state authority grants the Governor power to concur in the Secretary’s determination, then the Governor has no authority to concur. (See Confederated Tribes of Siletz Indians v. U.S. (9th Cir. 1997) 110 F.3d 688, 697-698 (Confederated Tribes) [noting the Governor acts under the authority of state law].)

My colleagues then split on whether the authority to concur in the Secretary’s determination that newly acquired land is suitable for gaming is implied from the Governor’s compacting authority under Proposition 1A, with the lead opinion avoiding the impact of that split by relying on a later revocation of the compact by voters. This analysis is one step too far down the road. Under the facts alleged in the complaint, appellants could state a legitimate claim that the Governor exceeded any constitutionally granted authority when concurring because, even if the power to concur was necessary to or implied within the authority to compact, the Governor was not properly executing the authority to compact.

Given that the Governor may only compact or concur if authorized under State law, a point discussed more fully, post, and that without authorization to act the California Constitution bars any conduct which would create Nevada- or New Jersey-style casinos, the meaning of the law defining the Governor’s authority is of paramount importance. (Hotel Employees, supra, 21 Cal.4th at p. 589; Confederated Tribes, supra, 110 F.3d at pp. 697-698.) The basic principles of statutory interpretation must therefore, in the first instance, be applied to the scope of the Governor’s authority under Proposition 1A.

I. Grammatical Structure of the Governor’s Compacting Authority.

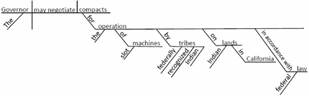

Proposition 1A grants a narrow and specific constitutional authority, providing the Governor “is authorized to negotiate and conclude compacts, subject to ratification by the Legislature, for the operation of slot machines and for the conduct of lottery games and banking and percentage card games by federally recognized Indian tribes on Indian lands in California in accordance with federal law.” (Cal. Const., art. IV, § 19, subd. (f).) By applying some non-substantive simplifications,4 the following sentence diagram can be generated:

This shows the Governor’s authority to negotiate compacts was substantially limited. The Governor’s compacting authority was limited in both the scope of gaming the compacts could grant, and the groups that could conduct that gaming, to “the operation of slot machines and for the conduct of lottery games and banking and percentage card games by federally recognized Indian tribes” (Cal. Const., art. IV, § 19, subd. (f)), which corresponds roughly to the class III gaming permitted by the IGRA. It was also limited as to where the Governor could compact for that gaming to occur, namely “on Indian lands in California.” (Cal. Const., art. IV, § 19, subd. (f).) And it was limited such that the compacts and restrictions must be considered “in accordance with federal law.” (Ibid.) In this case, it is the restriction to compacting for operations on Indian lands which precludes the Governor’s actions under the alleged facts of this case.

II. The Meaning of “Indian lands” as Used in Proposition 1A.

There is no direct definition of “Indian lands” in Proposition 1A. However, as is apparent from the general legal framework governing this issue, the proposition is readily understood to reference the IGRA through its specific provisions, its reference to allowing gaming operations “in accordance with federal law,” and its enactment following the failure of Proposition 5. (See Flynt v. California Gambling Control Com. (2002) 104 Cal.App.4th 1125, 1132-1137 [outlining the history of Indian gaming in California].) Indeed, the analysis by the Legislative Analyst for Proposition 1A preceded its explanation of how the changes proposed by Proposition 1A would affect gaming in California with a detailed explanation of how gaming regulations under the IGRA worked. Partially in light of this history, respondents concede that, in this appeal, “article IV, section 19, subdivision (f)’s plain meaning is to authorize the Governor to negotiate compacts for certain forms of otherwise illegal class III gaming to be conducted on Indian lands in California pursuant to IGRA.” As intervener puts it, the “history of Proposition 1A indicates that (1) the Governor may act ‘in accordance with federal law’ and (2) Indian tribes may conduct gaming on ‘Indian lands’ as that term is defined in IGRA....”

*16 I agree with respondents that, given the history of Proposition 1A, the term “Indian lands” should be understood to have the same meaning as used in the IGRA. And, turning to the IGRA, there is, in fact, a definition of “Indian lands” to apply. As noted above, this definition covers all land within the limits of any Indian reservation and “any lands title to which is ... held in trust by the United States for the benefit of any Indian tribe ... and over which an Indian tribe exercises governmental power.” (25 U.S.C.S. § 2703(4).) Under this definition, the Governor’s authority under Proposition 1A is limited to compacting for gaming on lands held in trust by the United States and over which an Indian tribe exercises governmental power.

III. Proposition 1A is a Conditional Authorization of Authority.

Given that the Legislature faces a blanket constitutional prohibition on authorizing Nevada- and New Jersey-style casinos under article IV, section 19, subdivision (e), of the state Constitution subject only to a limited compacting authority delegated to the Governor for such gaming on trust lands pursuant to subdivision (f), the notion that the Governor is vested with a broad authority to negotiate any compact which could ultimately result in gaming on later-created Indian lands (and has the concurring authority to enact those compacts) is difficult to defend. In support of this claim, respondents and intervener argue that a restriction on the Governor’s authority requiring the existence of “Indian lands” operates as an improper temporal limitation. As intervener further argues, the disputed provision “is a limitation on the content of compacts, not the time during which the Governor may negotiate and conclude the compacts.”

Although this argument generally contradicts the grammatical structure of the sentence which naturally reads such that the prepositional phrase “on Indian lands” modifies “for the operation” as opposed to “compacts,” in the abstract one could argue, as respondents and intervener do, that the language is simply a limitation on where the operation of slot machines must ultimately occur and not a limitation on the Governor’s authority to act in the first instance. However, such an argument ignores a key component of statutory construction—the contested terms must be understood both in the context of the section as a whole and in its contemporary legal context. (Graham County v. United States ex rel. Wilson (2005) 545 U.S. 409, 415 [explaining that “[s]tatutory language has meaning only in context”]; Stevens, Essay: The Shakespeare Canon of Statutory Construction (1992) 140 U.Pa. L.Rev. 1373, 1374-1381 [describing the first three cannons of statutory interpretation as “ ‘Read the statute,’ ” “ ‘Read the entire statute,’ ” and ensure “that the text be read in its contemporary context,”] italics omitted.)

In the broader context of article IV, section 19, subdivision (f) of the state Constitution is a limited authorization of authority carved out of a blanket prohibition. And in the broader social context, subdivision (f) was only enacted through Proposition 1A because other attempts to grant Indian tribes the authority to engage in gaming on Indian lands had been overturned by the California Supreme Court. Thus, the suggestion the Governor’s compacting authority is ever-present, provided that what is negotiated satisfies the authorizing statute at the time of implementation, runs contrary to the broader section’s text and the contemporary purpose for enacting Proposition 1A. The disputed limitation on the Governor’s authority to act is not temporal but conditional.

In other words, the fact the Governor’s authority can only be exercised when the conditions triggering that authority are met is not a temporal restriction on an existing authority. Like other conditional powers, the Governor’s authority only exists upon satisfying the condition needed to bring the right to act into existence. (Cf. Board of Trustees v. Garrett (2001) 531 U.S. 356, 374 [“Congress is the final authority as to desirable public policy, but in order to authorize private individuals to recover money damages against the States, there must be a pattern of discrimination by the States which violates the Fourteenth Amendment, and the remedy imposed by Congress must be congruent and proportional to the targeted violation.”]; City of Boerne v. Flores (1997) 521 U.S. 507, 517-520 [positive grant of legislative power to enforce 14th Amend. cannot be exercised unless record shows Congress is acting within that power by passing appropriate legislation]; see Lac Courte Oreilles Band of Lake Superior Chippewa Indians v. U.S. (7th Cir. 2004) 367 F.3d 650, 656-657 (Lac Courte Oreilles) [explaining how the IGRA is a conditional statute, where the authority to act requires certain factual predicates to exist before the Secretary may proceed (i.e.—the Secretary could not agree to take land into trust on the assumption that, by the time the act was complete, the Governor would concur) ].) As an example, picture a pet-sitting business. Assume a client says to the business, “You may take my dog for a walk on the sidewalk.” The most natural reading of this command is that the business is not permitted to take the dog for a walk unless that walk occurs on a sidewalk. If there is no sidewalk on which to walk, the business lacks authority to take the dog. If the business prepares for a walk, believing there is a sidewalk outside, it risks the possibility of being wrong and thus lacking authority to take the dog on a walk. And if the business nonetheless proceeds to take the dog on a walk, expecting a sidewalk to appear around the corner, the business has begun the walk without authority. Here too, while the Governor may wish to proceed with a compact, expecting Indian lands to appear prior to any gaming occurring, the Governor will be acting without authority at all times there are no Indian lands because the condition necessary to trigger the Governor’s authority to compact has not arisen.

IV. On the Facts Pled, the Governor Could Not Exercise His Compacting Authority.

*17 Having determined the initial limits of the Governor’s compacting authority under Proposition 1A, the question becomes whether the complaint “has stated a cause of action under any legal theory.” (Genesis Environmental Services v. San Joaquin Valley Unified Air Pollution Control Dist. (2003) 113 Cal.App.4th 597, 603.) The relevant facts, as set forth throughout the first amended complaint, are as follows:

On March 1, 2005, intervener applied to have “the Madera [s]ite taken into trust for the purposes of conducting class III gaming.” By letter dated September 1, 2011, the Assistant Secretary for Indian Affairs noted a favorable determination under the two-part analysis required by 25 United States Code Service section 2719 had been reached and requested the Governor concur. On August 31, 2012, the Governor responded by letter, concurring. When the Governor issued this concurrence letter, “he also announced that he had already negotiated a Compact with the Tribe.” The complaint then alleges the Governor’s concurrence “exceeded his authority under state law.”

Although the focus of the complaint is clearly on the Governor’s power to concur, the facts detailed above are sufficient to demonstrate the Governor exceeded the authority granted under state law as alleged. This is so because the Governor was alleged to have negotiated a compact for gaming on lands that were not “Indian lands.”5 At the time the Governor negotiated the compact and gave the disputed concurrence, the Secretary had not accepted the Madera property into trust under the only authority permitting such conduct, 25 United States Code Service section 5108. Without this acceptance, the land cannot be considered as held in trust by the United States. (25 C.F.R. § 151.3 [“No acquisition of land in trust status, including a transfer of land already held in trust or restricted status, shall be valid unless the acquisition is approved by the Secretary.”].) Because the land was not held in trust at the time the Governor negotiated the announced compact, the Governor was not negotiating a compact for gaming on Indian lands and, thus, exceeded any authority granted by Proposition 1A.

V. The Parties’ Framing of this Issue.

The parties have framed this issue in the context of the Governor’s power to concur in light of the constitutional power to compact, disputing whether such power would grant the Governor the ability to take lands from California for Indian use, thereby usurping the Legislature’s role in setting public policy and resolving land use issues. As appellants argued, the “primary issue in this appeal is whether the Governor has authority to authorize the Secretary to create new Indian land in California for the purposes of gaming by concurring in the Secretary’s two-part determination.” While respondents generally worked to rebut appellants’ claims, they too suggested authorization in the Governor to concur in the taking of lands into trust under the IGRA, writing: “When a tribe seeks a compact for gaming on Indian lands that are not taken into trust through the Secretary’s powers under 25 [United States Code Service section] 2719(b)(1)(A), a gubernatorial concurrence is not required.” It further directed the issue to this point by arguing that “[a]s long as Indian lands are established ‘in accordance with federal law,’ meaning IGRA, those lands become eligible for gaming.”6

*18 I agree with the general idea that the historical exclusion of casino gaming in California coupled with the history of Proposition 1A would not inform a voter that Proposition 1A was granting to the Governor the concurring authority to convert non-Indian land to Indian land in a manner which would authorize Nevada- or New Jersey-style casinos.

As the summary of the various laws and regulations show, however, this framing misses the mark. There is no provision of law in the IGRA which permits the Secretary to take lands into trust. The trust determination is wholly driven by the provisions of the IRA. And, while regulations may allow both proceedings to progress in tandem, the authority to concur in a determination that “newly acquired lands” are suitable for gaming purposes in no way grants the Secretary a right to take the land into trust under the IRA. At most, such a concurrence would support the Secretary’s determination that taking the land into trust would benefit the tribe because gaming would not be blocked at a later date and, thus, the economic impacts of the decision would be clearer.

All parties appear to recognize this fact, at least implicitly, at some point in their briefing. For example, respondents explain in their summary of the law, that while “the IRA governs federal action to take land into trust for Indian tribes, IGRA governs a federal decision to allow such trust land’s use” for gaming purposes. Likewise, intervener clearly explains that the IRA “governs the federal government’s acquisition of land for the benefit of Indian tribes” while the IGRA aims only to “facilitate ‘the operation of gaming by Indian tribes.’ ” This split in framing and understanding appears to arise from a conflict that may be unique to California and derives from California’s start and stop history in regulating Indian gaming.

In the federal regulatory scheme, the Secretary is permitted to conduct analyses with respect to the suitability of gaming on “newly acquired lands.” (25 U.S.C.S. § 2719(b)(1)(A); 25 C.F.R. § 292.13.) By regulatory definition, such lands include not only those already held in trust, but also those that “will be taken” into trust. (25 C.F.R. § 292.2.) In contrast, California’s Proposition 1A arose in part as a mechanism to ratify several previously negotiated compacts. (California Commerce Casino, Inc. v. Schwarzenegger (2007) 146 Cal.App.4th 1406, 1412.) In doing so, it approved the Governor’s prior unauthorized compacting, weakened the constitutional restriction on the Legislature’s authority to permit Nevada- and New Jersey-style casinos, and delegated compact power to the Governor, subject to ratification by the Legislature. As part of this change, Proposition 1A tightly limited the Governor’s future authority to compact such that he could only negotiate for gaming “on Indian lands.” (Cal. Const., art. IV, § 19, subd. (f).) In this way, California’s Constitution was amended to grant the Governor a right to compact which covers only half of the potential proceedings occurring under the federal regulatory scheme.7,8

*19 It must be noted that the Seventh Circuit, in Lac Courte Oreilles, supra, 367 F.3d at page 656, wrote, “Unless and until the appropriate governor issues a concurrence, the Secretary of the Interior has no authority under [25 United States Code Service section] 2719(b)(1)(A) to take land into trust for the benefit of an Indian tribe for the purpose of the operation of a gaming establishment.” While this statement would appear to contradict the prior analysis, I find it distinguishable on at least three grounds.

First, the issue under consideration in Lac Courte Oreilles was whether the IGRA’s concurrence provision was an unconstitutional violation of the separation of powers doctrine. (Lac Courte Oreilles, supra, 367 F.3d at p. 655.) The court’s understanding of the basis for invoking the request for concurrence, as authority to take the land into trust or authority to permit gaming on newly acquired land, was therefore immaterial to the resolution, rendering this analysis dicta. Indeed, the court used the above statement in order to analogize the legislation to other examples of “contingent legislation” which had been held constitutional. (Id. at p. 656.)

Second, the factual scenario considered in Lac Courte Oreilles was different in a material way. In Lac Courte Oreilles, the Governor had declined to concur in the Secretary’s findings, precluding the requested authorization for gaming and triggering a dispute concerning the Governor’s authority to affect federal law. (Lac Courte Oreilles, supra, 367 F.3d at p. 653.) As such there was no detailed discussion of Wisconsin’s laws or policies with respect to the Governor’s authority to act. In contrast, here the Governor concurred with the Secretary, triggering a different dispute concerning whether, under California law, the Governor had the authority to issue that concurrence.

Finally, and most importantly, the court’s statement in Lac Courte Oreilles is not accurate. There is no technical reason under the law, provided the proper Administrative Procedure Act (APA) requirements are met, that the Secretary could not take land into trust for the purpose of gaming without the Governor’s concurrence.9 This is so because the authority to act arises under 25 United States Code Service section 5108 and not section 2719. Should the Secretary so act and survive the likely challenge under the APA, however, 25 United States Code Service section 2719 would still bar class II or III gaming on the property unless and until an exception applied—such as the Governor’s concurrence provision. Thus, in the context of a dispute arising when a request for a trust determination was made under 25 United States Code Service section 5108 at the same time as a request for a determination that the newly acquired property is suitable for gaming under 25 United States Code Service section 2719, it would be understandable, though not wholly correct, to claim the property could not be taken into trust for the purpose of gaming unless the Governor concurred. To the extent Lac Courte Oreilles suggests the Governor’s concurrence is required to take land into trust, I do not find it persuasive authority.

VI. The Governor’s Executive Authority.

*20 The Governor’s concurrence could still be accepted as valid in this case if the Governor held the authority to concur as a power inherent to the chief executive of the state. I concur with and join Justice Franson’s conclusion that no such authority exists. I find persuasive his analysis showing that the California Constitution expressly bans the creation of Nevada-or New Jersey-style casinos. (Cal. Const., art. IV, § 19, subd. (e).)

This general prohibition demonstrates forcefully that the Governor does not possess the power to act in a manner which would result in the authorization to operate Nevada- or New Jersey-style casinos within California absent some express grant of that right. While it is true the Governor’s concurrence does not, by itself, create permission to operate such casinos in California, that authority being expressly found only in the Secretary, there can be no doubt the practical effect is the same. (See Lac Courte Oreilles, supra, 367 F.3d at p. 663 [rejecting argument that impact of gubernatorial inaction violated federalism principles because federal government could grant states input into execution of federal law]; Confederated Tribes, supra, 110 F.3d at p. 698 [noting that Secretary must comply with guidelines expressed by Congress and that Governor plays limited role by concurring once the Secretary has determined gaming would be appropriate].) At the time the Secretary requests concurrence, a preliminary determination that operation of class III gaming on the identified lands is appropriate has already been reached. (See 25 C.F.R. § 292.13; Lac Courte Oreilles, supra, 367 F.3d at p. 663 [explaining that due to the transparent nature of the IGRA, “if the Secretary of the Interior issues a favorable finding, but ultimately denies the application, the constituents will gather that the governor likely declined to issue a concurrence”].) Given that the California Constitution expressly forbids the authorization of such gaming, and that the exception created by Proposition 1A only applies to “Indian lands,” there can be no inherent authority in the Governor to concur in the conclusion that gaming may occur on “newly acquired lands” which are not already in trust.10

I also find this constitutional prohibition is confirmation that the underlying authority to concur in the Secretary’s determination to authorize Nevada- or New Jersey-style casinos on newly acquired lands is inherently and wholly legislative. By expressly removing the authority to authorize Nevada-and New-Jersey style casinos from within the broad plenary powers of the Legislature, then placing partial authority to compact for such casinos with the Governor, subject to express ratification from the Legislature, the California Constitution leaves no doubt that the authority to authorize such casinos cannot exist within the Governor’s inherent executive authority. During our consideration of this case, another court of appeal reached a contradictory result in United Auburn Indian Community of Auburn Rancheria v. Brown (2016) 4 Cal.App.5th 36 (United Auburn). United Auburn reviewed three general legislative spheres and found the Governor’s concurring power did not fall exclusively within any of those three. (Id. at pp. 47-51.) Then, relying on Lac Courte Oreilles, the court determined the concurring power had some “[e]xecutive [c]haracteristics,” while failing to expressly call it an executive power, because it allegedly involves the implementation of existing Indian gaming policy in California. (United Auburn, supra, 4 Cal.App.5th at pp. 51-52.) I am not persuaded by this analysis.

*21 As the court in United Auburn noted, case law in California stands “for the unremarkable proposition that the Governor may not exercise a legislative power without express authority from the Legislature.” (United Auburn, supra, 4 Cal.App.5th at p. 47.) California’s constitutional ban on the legislative authority to authorize gaming and the later amendment granting limited powers to the Governor in that context demonstrates forcefully that this proposition is the controlling law. Yet, United Auburn makes no reference to this history or its implication.

Similarly, United Auburn’s reliance on Lac Courte Oreilles to conclude concurring has an executive characteristic under California law is misplaced. As United Auburn noted, Lac Courte Oreilles found extensive gaming regulations in Wisconsin meant there was a general policy, consistent with the Wisconsin Constitution, which the Governor was simply enforcing. (United Auburn, supra, 4 Cal.App.5th at pp. 51-52.) Lac Courte Oreilles conducted its analysis by following an earlier United States Supreme Court case considering California’s authorization of bingo. In that case, California v. Cabazon Band of Mission Indians (1987) 480 U.S. 202 (Cabazon), the Supreme Court noted that California allowed several forms of gambling to occur, including bingo and the card games being operated by the tribe, but had sought to criminalize high stakes, unregulated bingo. (Id. at p. 211.) In the context of these facts, the Supreme Court found “California regulates rather than prohibits gambling in general and bingo in particular” and, thus, could not enforce its stricter bingo regulations on reservations. (Id. at pp. 211-212.)